| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 20

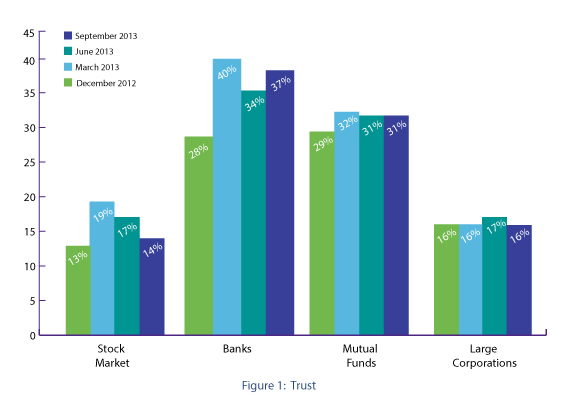

CHICAGO (October 22, 2013) — Americans are feeling pretty positive about places they can put their money according to the latest data from The Chicago Booth/Kellogg School Financial Trust Index. “The Financial Trust Index is holding steady, in line with stable expectations about future housing prices and stock market performance,” says co-author Luigi Zingales, the Robert C. McCormack Professor of Entrepreneurship and Finance and the David G. Booth Faculty Fellow of the University of Chicago Booth School of Business.

The quarterly survey—which has been tracking trust across key financial institutions for the last five years—expanded its scope for this 20th report to include sentiment about the Federal Reserve, including outgoing chair, Ben Bernanke. Co-author Paola Sapienza, the Merrill Lynch Capital Markets Research professor of finance at the Kellogg School of Management at Northwestern University reports, “We found that 56 percent of respondents were favorable to Bernanke’s performance as chairman of the Federal Reserve—eight percent were very favorable, in fact—while 17 percent were very unfavorable.” The survey was done at the end of September, just prior to President Obama’s nomination on October 9, 2013, of Janet Yellen to take over the post. With Bernanke’s term coming to a close, Zingales says, “We asked a survey subset—727 respondents who said they’re familiar with Fed policy—about the most important characteristics a new Fed chairperson should have. The two most important qualities they cited were ‘Credibility’ (42 percent of respondents) and the ‘Ability to foresee economic trends’ (41 percent).” While only one percent of respondents chose ‘Honesty/Integrity’ as essential for the next leader of the Federal Reserve, Zingales points out, “This doesn’t necessarily mean the public doesn’t value honesty. But rather, in light of the jolts to the financial world in recent years, people may feel that it’s paramount that the next Fed chair be credible and able to accurately predict economic trends.”

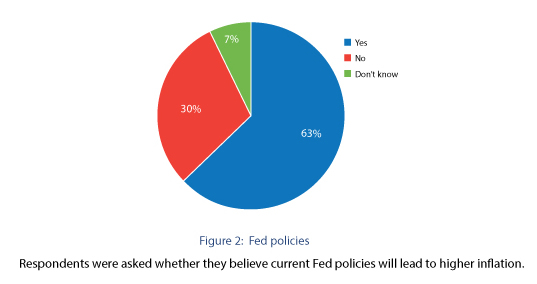

Regarding broader impacts on the economy, Sapienza explains, “Within this group familiar with Fed policies, 63 percent are concerned that current Fed strategy will lead to higher inflation, while 30 percent do not share that concern.” When asked about Fed performance in regulating banks, Sapienza says that within this same subset, “58 percent think the Federal Reserve has been too lenient, 30 percent said it was just about right, and the remaining 12 percent believe the Fed’s been too tough.” The Chicago Booth/Kellogg School Financial Trust Index is a quarterly measure of public opinion tracking attitudes toward financial institutions—banks, credit unions, the stock market, mutual funds, insurance companies and large corporations. The data provides a gauge of how much trust Americans have in the places they can invest their money. |

|||||