| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 16

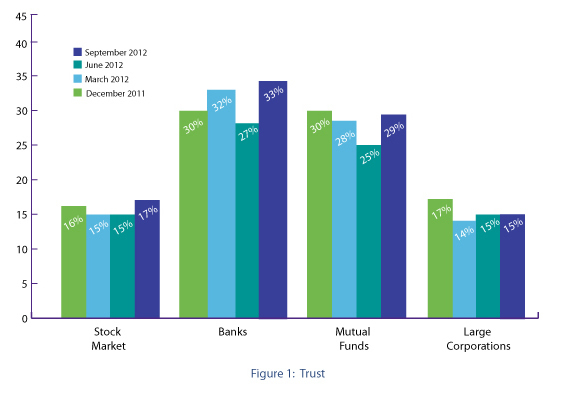

Paola Sapienza and Luigi Zingales1 CHICAGO (October 30, 2012) – As the economy continues to be a top issue for voters in the final days of the presidential campaign, a new report finds that 23 percent of Americans say they trust the country’s financial system. According to the latest Chicago Booth/Kellogg School Financial Trust Index, this is an increase of two percentage points since the last issue of the Index in June 2012 and reflects a rebound of trust in the banking sector.

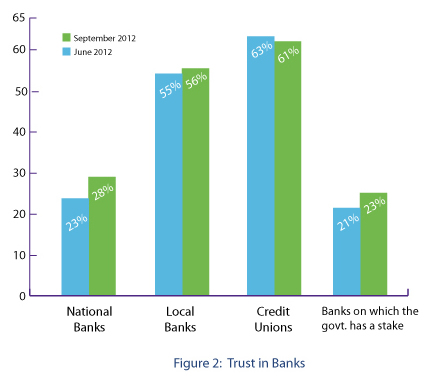

The Index measures public opinion over three-month periods to track changes in attitudes. This report is the 16th quarterly update and is based on a survey conducted in September 2012. Zingales added that this gain in the banking sector was largely driven by an increase of trust in national banks in particular, which rose by five percentage points to 28 percent since the last report. Also, trust in community banks and credit unions remained relatively high at 56 percent and 61 percent, respectively.

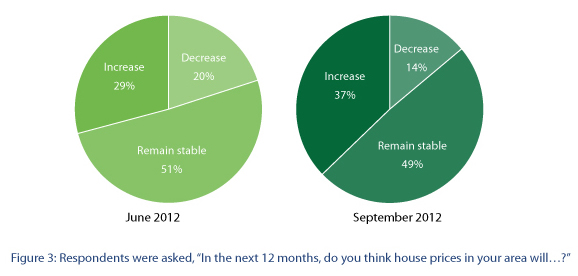

Other factors important to voters in this year’s election improved in this issue of the Financial Trust Index, such as increased optimism on the U.S. housing front. Thirty-seven percent of people surveyed said they think house prices will increase in the next 12 months, as compared to 14 percent who think they will decrease.

“We saw similar improvements on the job front in this quarter’s survey, with only 12 percent of respondents saying they fear losing their jobs in the next 12 months,” said Paola Sapienza, co-author of the Financial Trust Index and the Merrill Lynch Capital Markets Research professor of finance at the Kellogg School of Management at Northwestern University. “This is an improvement from 15 percent just three months ago, and is significantly lower than the 23 percent we reported in December 2008 in the earliest months of the financial crisis.” Other findings from this quarter’s Financial Trust Index include:

ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust that Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) as part of their weekly national telephone survey, EXCEL. In the most recent wave, a total of 1,011 individuals were surveyed by live interviewers (not IVR) from Sept. 19 to Sept. 26, 2012. The institutions considered in the survey are banks, the stock market, mutual funds and large corporations. 1 Paola Sapienza is the Merrill Lynch Capital Markets Research Professor of Finance at the Kellogg School of Management at Northwestern University. Luigi Zingales is the Robert R. McCormack Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business. |

|||||||