|

Paola Sapienza and Luigi Zingales1

CHICAGO (May 2, 2012) – The latest issue of the Chicago Booth/Kellogg School Financial Trust Index finds that only 22 percent of Americans trust the nation’s financial system. Yet, according to the March 2012 report released today, fewer people fear a large stock market drop, there is a slight uptick in trust in banks, and Americans are more confident about home values increasing compared to three months ago.

“This quarter we also saw an increased appetite for financial risk,” said Luigi Zingales, co-author of the Financial Trust Index. “Although some areas of the study show a drop in trust – with some components hovering at very low levels – 25 percent of people surveyed demonstrated a willingness to make potentially high-yielding investments despite higher risks.”

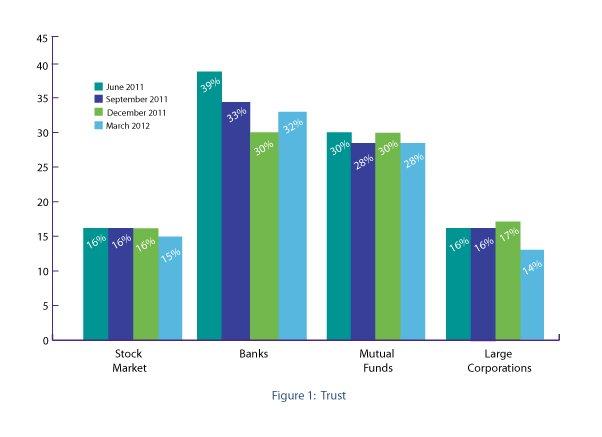

Trust in the stock market, mutual funds and large corporations all dwindled slightly in this survey, but trust in banks rose by two percentage points to 32 percent.

Percentage of people trusting various components that comprise the Financial Trust Index.

|

|

On housing market expectations, 32 percent of respondents believe housing prices will increase in the next 12 months (compared to 26 percent in December 2011).

Respondents were asked, "In the next 12 months, do you think house prices in your area will…?" |

|

However, the number of people who say they know someone who strategically defaulted on their mortgage rose to 37 percent from 32 percent in December 2011.

The Chicago Booth/Kellogg School Financial Trust Index measures public opinion over three-

month periods to track changes in attitudes. Today’s report is the 14th quarterly update and is based on a survey conducted in March 2012.

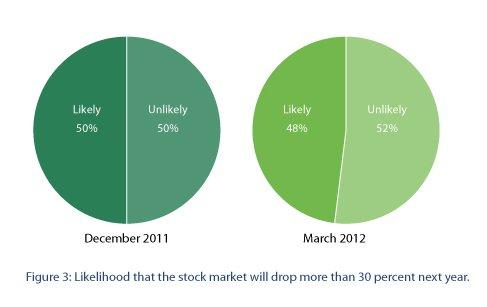

Respondents were asked, “In your opinion, what is the likelihood that the stock market will drop by more than 30 percent in the next 12 months?” |

|

Opposing Views: Average Americans vs. Economists

To take a closer look at several finance and economic policy questions, this issue of the Financial Trust Index also compared public opinion to the opinions of the Chicago Booth IGM Economic Experts Panel, a panel of distinguished economists with a keen interest in public policy from the major areas of economics.

Similar to the December 2011 report, the report found a high level of contrast between the opinions of average Americans and economists. Key findings include:

- Bank Bailout Impact on Unemployment: Americans are much less persuaded than economic experts that the 2008 bank bailout reduced unemployment. A strong majority of economists (78 percent) agreed that the U.S. unemployment rate was lower at the end of 2010 due to the government’s intervention. Only 43 percent of the Index sample agreed with that statement.

- The Effect of Obama’s Stimulus Plan: Nearly half (46 percent) of Americans surveyed agreed that the unemployment rate was lower at the end of 2010 than it would have been without President Obama’s 2009 stimulus plan. In contrast, 80 percent of the economic experts felt the stimulus contributed to lower unemployment.

However, Americans and economists alike believed the benefits of the stimulus plan will ultimately outweigh the costs. Nearly 43 percent of the people surveyed in the Financial Trust Index agreed, as did 46 percent of the economic experts.

- Top Executives are Paid Too Much, Public Believes: The Index finds that 67 percent of Americans believe that the typical corporate chief executive is paid more than the value he or she adds to the firm, while only 32 percent of economic experts agree with that statement.

- Little Support for Gas Tax to Reduce Emissions: Sixty-four percent of respondents disagree somewhat or strongly with the statement that a gas tax is a better way to reduce carbon-dioxide emissions than mandatory standards for cars. Only two percent of the experts disagree with that notion. In fact, 90 percent of the experts agree somewhat or strongly that a gas tax is preferable to auto standards as a way to control emissions.

Credit Constraint

Finally, this wave of the Financial Trust Index also looked at the issue of credit. “We found that 17 percent of Americans are ‘credit constrained;’ that is, they either were rejected for a loan or simply did not apply for fear of being rejected,” said Paola Sapienza, co-author of the Financial Trust Index. “Interestingly, most of these people reported incomes less than $50,000, but about three percent earn more than $100,000.”

ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust that Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) using ICR/International Communications Research’s weekly telephone poll service. As part of the most recent wave, a total of 1,026 individuals were surveyed from Mar. 21 to Mar. 27, 2012. The institutions considered in the survey are banks, the stock market, mutual funds and large corporations.

1 Paola Sapienza is the Merrill Lynch Capital Markets Research Professor of Finance at the Kellogg School of Management at Northwestern University. Luigi Zingales is the Robert R. McCormack Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business. |

|